Excellent Guidance Regarding House Mortgages That You Will Intend To Check Out

Article written by-Alexander BynumIt's very rare that someone has the cash available to purchase a home outright, and this is where a home mortgage loan comes in. But with the way lenders are treating homebuyers in this economy, you'll probably either be declined or end up paying too much interest. The only way around this is to learn about lenders so you can communicate on their level.

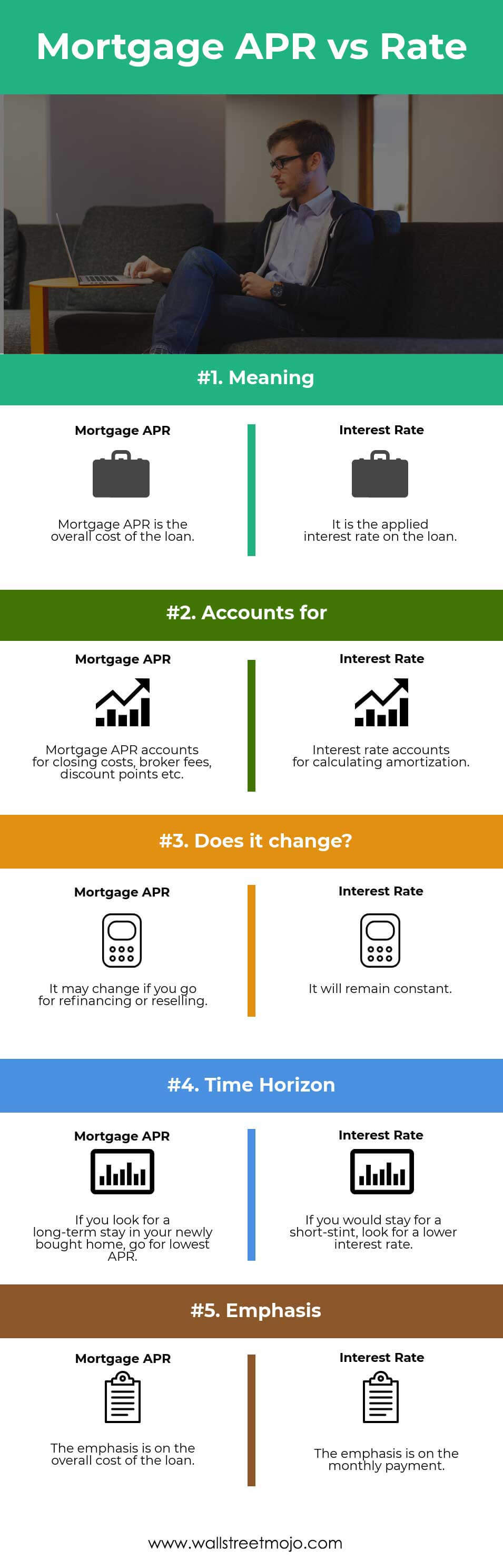

When it comes to getting a good interest rate, shop around. Each individual lender sets their interest rate based on the current market rate; however, interest rates can vary from company to company. By shopping around, you can ensure that you will be receiving the lowest interest rate currently available.

Be prepared before obtaining your mortgage. Every lender will request certain documents when applying for a mortgage. Do not wait until they ask for it. Have the documents ready when you enter their office. You should have your last two pay stubs, bank statements, income-tax returns, and W-2s. Save https://www.bizjournals.com/sacramento/news/2022/01/10/acquisition-of-suncrest-bank-completed.html of these documents and any others that the lender needs in an electronic format, so that you are able to easily resend them if they get lost.

You should have a work history that shows how long you've been working if you wish to get a home mortgage. Many lenders insist that you show them two work years that are steady in order to approve your loan. Changing jobs frequently can lead to mortgage denials. Do not quit your job while a loan application is in process.

When you see a loan with a low rate, be sure that you know how much the fees are. Usually, the lower the interest rate, the higher the points. These are fees that you have to pay out-of-pocket when you close your loan. So, be aware of that so you will not be caught be surprise.

Understand the difference between a mortgage broker and a mortgage lender. There is an important distinction that you need to be aware of so you can make the best choice for your situation. A mortgage broker is a middle man, who helps you shop for loans from several different lenders. A mortgage lender is the direct source for a loan.

Take the time to get your credit into the best shape possible before you look into getting a home mortgage. The better the shape of your credit rating, the lower your interest rate will be. This will mean paying thousands less over the term of your mortgage contract, which will be worth the wait.

Research potential mortgage lenders before signing your bottom line. Do not only listen to the lender. Ask family and friends if they are aware of them. The Internet is a great source of mortgage information. Check out the BBB. You have to know as much as possible before you apply.

Find out how to avoid shady mortgage lenders. A lot of lenders are legitimate, but some will try to bilk you for everything you have. Avoid the lenders who talk smoothly and promise you the world to make a deal. Unnaturally high rates are a red flag, so do not sign any papers. Some lenders will claim that bad credit ratings won't be a problem. Be weary of these lenders. Always avoid those lenders that say it's alright to give false information on your application.

Make sure you pay down any debts and avoid new ones while in the process of getting approved for a mortgage loan. Before a lender approves you for a mortgage, they evaluate your debt to income ratio. If your debt ratio is too high, the lender can offer you a lower mortgage or deny you a loan.

Use local lenders. If you are using a mortgage broker, it is common to get quotes from lenders who are out of state. Estimates given by brokers who are not local may not be aware of costs that local lenders know about because they are familiar with local laws. This can lead to incorrect estimates.

Settle on your desired price range prior to applying for mortgages. If you are approved for a bit more, you'll have some flexibility. But remember to never buy more than https://www.aba.com/about-us/press-room/press-releases/indiana-banker-and-ohio-farm-broadcaster-receive-top-ag-banking-awards can really afford. Doing this may make you have a lot of problems with finances later on.

Be sure that you know exactly how long your home mortgage contract will require you to wait before it allows you to refinance. Some contracts will let you within on year, while others may not allow it before five years pass. What you can tolerate depends on many factors, so be sure to keep this tip in mind.

Keep your credit score in good shape by always paying your bills on time. Avoid negative reporting on your score by staying current on all your obligations, even your utility bills. Do take out credit cards at department stores even though you get a discount. You can build a good credit rating by using cards and paying them off every month.

Never assume that a mortgage is going to just get a home for you outright. Most lenders are going to require you to chip in a down payment. Depending on the lender, this can be anywhere from 5 percent to a full fifth of the total home value. Make sure you have this saved up.

Never sign home mortgage paperwork that has blank spaces. Also, make sure you initial each page after you read it. This ensures that terms cannot be added after you sign. Unscrupulous lenders may be inclined to add pages to your contract which you did not read, and this protects you from this practice.

Set a budget prior to applying for a mortgage. If you end up being approved for more financing than you can afford, you will have some wiggle room. However, it is critical to stay within your means. Doing so could cause severe financial problems in the future.

Compare the loan origination fees. There is more to a loan than just the interest rate that you agree to. Points are applied to the loan as well, and can mean a great deal when it comes to what your total cost will be on your home mortgage. Keep this in mind from the start.

You can find a great mortgage for you when you are informed. A mortgage is often the biggest financial commitment you make in your life. You want to enjoy your home and not see it as a financial burden. Rather, you need a mortgage that leaves you breathing room, from a lender you can trust.